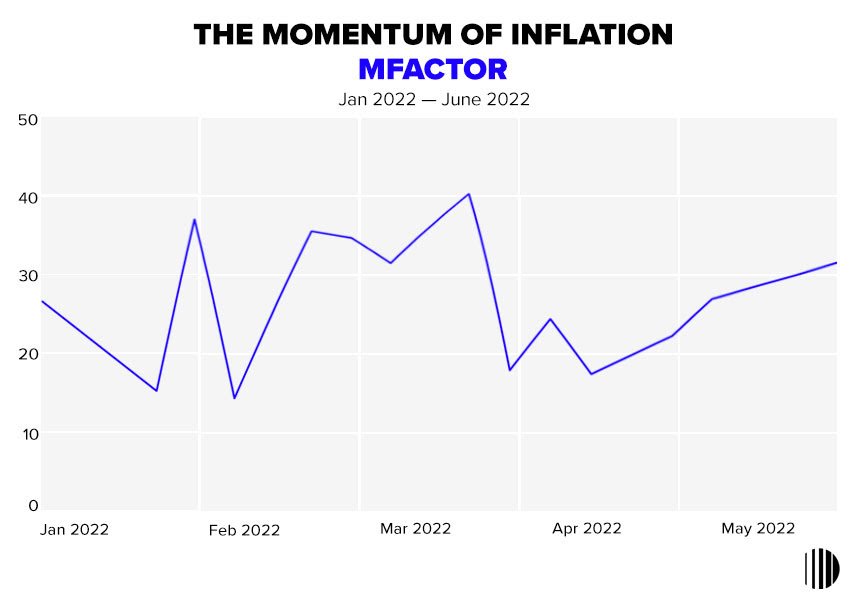

The Momentum of Inflation

People are hurting out there.

With inflation at a 40-year high, up to 60% of Americans live paycheck to paycheck despite a strong job market, wage gains, and stimulus savings. People’s confidence in the economy — and in their futures — is crumbling.

More than anything else, inflation drives the feeling of uncertainty. And that causes people to reassess their priorities as they become more cautious and deliberate.

That feeling of uncertainty is our new reality for the foreseeable future. Here’s how to make sense of it all.

WHAT’S UP ⬆️:

As prices creep up, shoppers cut back. Americans are making a major 180 on their pandemic era spending habits, with less trips to stores and fewer items bought. It’s part of a larger trend of uncertainty and inflation fundamentally changing consumer behavior.

The Retail Recoil

During times of uncertainty, people make two big changes: they stop spending on nonessentials and they switch to cheaper alternatives. That’s exactly what America’s biggest retailers are experiencing. Last month, Walmart noted that its customers have been downgrading from brand names to cheaper private label goods. Target said that shoppers are still spending big on daily essentials, but cutting back on discretionary purchases like home goods, furniture, TVs and kitchen appliances.

The Last Unicorn?

For years, venture capitalists funneled billions into countless deeply unprofitable startups, because near-zero interest rates let them gamble on potential unicorns with less risk. But with the Fed raising interest rates to cool inflation, investors are having second thoughts about these long-shot bets. It’s one of the big reasons why Silicon Valley is feeling especially grim, with dozens of startups announcing layoffs.

Save Now, Pay Later

Is this the end of Buy Now, Pay Later? Economic uncertainty means people can’t be sure that they’ll have the money to make a future payment, and those who do may prefer to build credit by using a traditional card.

In its place, companies like Accrue Savings are on the rise thanks to its “Save Now, Pay Later” model. When someone wants to buy a product from a participating retailer, Accrue creates saving plans — complete with cash rewards for reaching certain goals to incentivize saving. Once the shopper chooses a plan, they receive an FDIC-insured savings account, and once the amount in it meets the cost of the item, the shopper completes their purchase.

WHAT’S DOWN ⬇️:

Big ticket luxury products are going to be in a tough spot as we all scale back nonessential spending. But the hardest hit brands will be those of the “Millennial Lifestyle Subsidy,” the patchwork of formerly-cheap apps and subscription services that has come to define urban living.

WHAT’S NEXT ➡️:

| D Disruption |

We all know that investing in crypto is a volatile, high risk proposition. Still, the crypto crash has turned some core assumptions upside-down. Part of the pitch behind crypto is that its independent, decentralized nature would cushion it against inflation and other economic crises. But it’s clear now that crypto is deeply connected to the larger financial market. |

| I Innovation |

According to consumer behavior experts, people will still spend on little Treat Yo Self moments even in economic downturns. That’s why brands like Bath & Body Works are innovating by positioning their products as “affordable luxuries.” The pivot is paying off, with soap and air freshener sales higher last quarter vs. one year ago. |

| P Polarization |

Many consumers feel that businesses are taking advantage of inflation to increase prices beyond what’s needed. "Greedflation," as it's called, doesn’t explain the full economic picture. But it does explain why, say, oil companies aren’t ramping up production to help alleviate soaring gas prices amid record profits. | S Stickiness |

Between COVID-19, supply chain issues, and the war in Ukraine, businesses have been cut slack for rising costs. But that won’t last forever. According to Deloitte’s latest consumer survey, soon people will direct their ire toward companies… and the biggest losers will be luxury brands that very visibly raised prices during the pandemic. |

| S Social Impact |

The social impact of inflation is well-known: it deepens America’s already enormous wealth gap. Low income people spend a higher proportion of their total income on necessities like rent, food, and energy. Higher income people have more savings and more discretionary spending they can cut back on. Homeowners even benefit from inflation because home equity increases with housing prices. |